So, you run a solid business. But a lot of your productive time gets consumed by manual tasks like tracking employee attendance, managing salaries, and handling the ever-changing tax regulations. Why put in so much effort when there’s a simple tech solution available? For instance, Payroll software in Pakistan.

So, stay here, and get all the know-how of payroll software, its features, the best options, and how to get your best one.

Why Your Business Needs Payroll Software in Pakistan

Well, running a business in Pakistan demands its own unique set of payroll challenges. If you’ve been handling payroll manually, you already know how tricky it can get. The local landscape isn’t as smooth sailing as you’d hope. And that’s where payroll software steps in to save your day.

First, complex tax regulations. You know very well how it is difficult to keep track of ever-changing tax laws. Your one wrong calculation can mean penalties or compliance issues. Payroll software helps you to avoid all this mind-numbing mess.

Next, you probably have a mix of full-time employees, part-timers, and contractors among your workforce. Every group has different perks, deductions, and salary scales. Handling all of this by hand can be a nightmare. So, why work so hard when a simple payroll software can manage all?

Then, there’s attendance tracking. Are you still holding a register in your hand and marking everyone’s presence, like in the old school system? Well, it’s a tech era and one payroll software automates this within seconds.

Finally, administrative burden. Your productive time needs to handle other crucial business things. So, payroll software saves you time and money. It also helps you avoid the headaches of manual payroll management.

Key Features to Look for in Payroll Software

Need payroll software, but confused about what to look for while buying one. Here’s how you can solve it.

✅️ Time & Attendance Integration

Payroll syncs the attendance flawlessly. You know how crucial the accurate tracking of hours, leaves, and absences is for fair and timely salary disbursement.

✅️ Accurate Payroll Calculations

Your software should crunch numbers flawlessly. It needs to manage compensation, taxes, and benefits.

✅️ Salary Verification & Structure

Seek software that offers a transparent compensation breakdown and confirms figures. Workers will like having easy access to their pay history.

✅️ One-Click Payroll Processing

Time is money! Your system should streamline payroll with just a click.

✅️ Taxes & Compliance Management

You need to keep up with the latest developments in taxes and compliance management! So, according to local rules, your program ought to automatically determine and submit the necessary taxes.

✅️ Direct Online Salary Deposit

Steer clear of the headache caused by late payments. Select software that allows for direct deposits into the bank accounts of your employees.

Comparing the Top Payroll Software Providers in Pakistan

| Features | PayPeople | Resource Inn | ConnectSimpli |

|---|---|---|---|

| Overview | AI-powered HR solution with comprehensive features | Top payroll management program for legal compliance | Simple, budget-friendly payroll solution for SMEs |

| Automated Payroll | Yes | Yes | Yes |

| Employee Portal | Yes (Self-Service) | Yes (Mobile-enabled) | Yes (Easy-to-use platform) |

| Compliance Management | Yes (automated compliance tracking) | Yes (salary taxes, statutory deductions) | Yes (digital tax services and compliance) |

| Mobile Access | Yes (mobile-first approach) | Yes (PTO management through mobile app) | Yes (intuitive mobile apps) |

| Reporting & Analytics | Advanced reporting and dashboards | Comprehensive reporting for various functions | Insightful analytics for workforce insights |

| Customer Support | Yes | Yes | 24/7 online support |

| Data Security | Yes (high security measures) | Yes | Yes (high emphasis on data security) |

| Time Efficiency | Yes | Yes | Yes (optimizes time through automation) |

| Unique Features | Digital wallet, telemedicine access, one-click insurance claim | Effective travel and official duty management | Strategic tax planning, expert support, automated salary calculations |

| User-Friendliness | Yes | Yes | Yes (streamlined interface for quick adjustments) |

| Pricing | Custom pricing based on features and employees (Yearly, Semi-Annually, Quarterly, Monthly) | Starts from PKR 3,500/month (customizable plans) | Rs. 0 per employee per month (Free for up to 5 employees) with add-on services available. Pricing varies based on specific add-on services (e.g., tax filing, registrations) |

| Additional Services | Yes (various integrations and services) | Yes (additional HR services available) | Yes (add-ons for tax filing, NTN registration, etc.) |

How Payroll Software Improves HR Efficiency

If you are using payroll software, then get ready for pleasure surprises. Yes, such software will make your business life quite productive. How? Let’s see:

First, Payroll software automates repetitive tasks such as payroll calculations, tax deductions, and compliance reporting. So, you don’t need that manual data entry and calculations.

Then, all your employee information, including attendance, leave balances, and compensation is stored in a single platform. So, you can retrieve data within seconds.

Next, no human error. We humans are prone to errors. But this rule doesn’t apply to software.

Now the best part. Payroll software often includes features that automatically update with changes in tax laws and regulations. So, you don’t need to worry about those tax regulations. Your payroll is ready to handle those mentally exhausting regulations.

You can do a lot more such as timely payments, correct tax filing, and let’s not talk about time. These software products are meant to save you time.

Tips for Choosing the Best Payroll Software for Your Business

You acknowledged how payroll software impacts your business. Now you need one, that perfectly fulfills your hefty demands. Here’s how you can choose your payroll software.

- First, determine what your business requires. Decide which features you absolutely must have, such as employee self-service portals, automated tax computations, or connectivity with current HR systems.

- Think about your spending plan. Compare price lists, and look for add-ons.

- Consider scalability. Select software that expands with your business’s needs. As you plan to grow your business or hire more staff, make sure the software can accommodate the extra load.

- Make sure it’s user-friendly. Select a solution that has an easy-to-use interface. Optimal user experience lowers training expenses and saves time.

- Don’t forget mobile access. With a mobile-friendly platform, you can manage payroll on the go.

FAQ

What is the best payroll software in Pakistan?

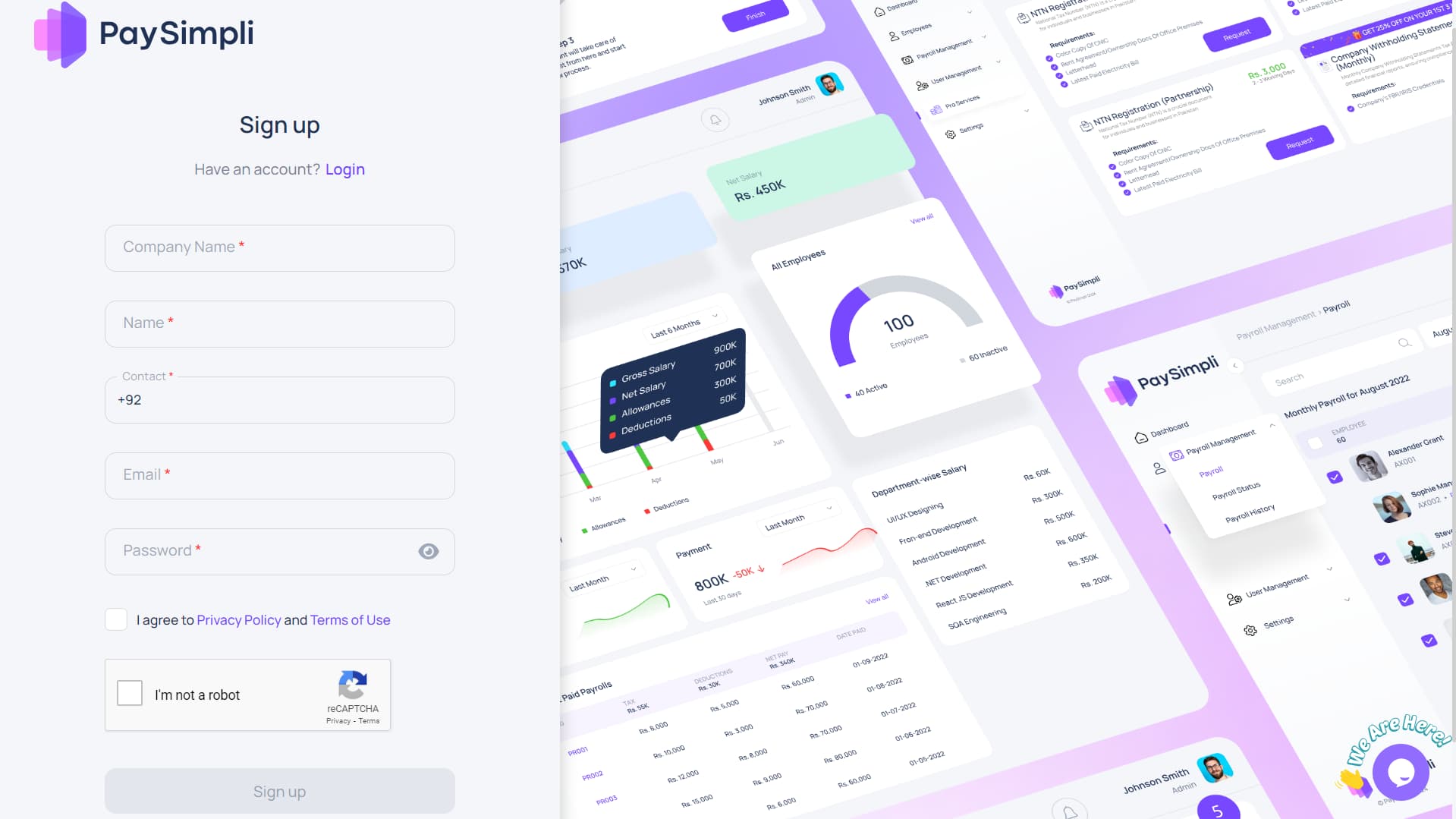

The best payroll software in Pakistan varies. It all depends on your business needs. However, popular options include PayPeople, Resource Inn, Clan, and ConnectSimpli.

How does payroll software work?

Payroll software automates tax calculations, employee pay cheque processing, and compliance. It collects data on hours worked, deductions, and perks to provide accurate pay stubs and reports.

Can payroll software be customized for Pakistani tax laws?

Yes, many payroll software solutions can be customized to comply with Pakistani tax laws.

Is cloud-based payroll software secure for businesses in Pakistan?

Cloud-based payroll software can be secure. So, if you need cloud-based payroll, always check the provider’s security measures and compliance standards.

How much does payroll software cost in Pakistan?

The cost of payroll software in Pakistan varies widely depending on the provider and features. Some solutions offer free plans for small businesses, like ConnectSimpli. Most may charge monthly or yearly fees.