You need payroll software that gets the job done. The essential features of payroll management are vital for small businesses, HR teams, and CEOs. Choosing the right solution can expedite your payroll processes, improve compliance, and enhance your overall performance. With the right tools, you can reduce errors, save valuable time, and keep your employees happy.

You know, in the end, it’s all about creating a smooth experience for your team. So, let’s dig in and make it happen!

The Role of Payroll Management Software in Modern Businesses

Do you believe that payroll management software is your right hand in managing employee compensation with ease? How so? Because, it automates the nitty-gritty details calculating wages, deductions, and taxes without breaking a sweat. You simply input hours worked, and voilà! The software takes care of gross and net pay effortlessly. You don’t need to worry about tracking overtime, bonuses, and benefits.

But it doesn’t stop there. This software also generates payslips and tax documents automatically, integrating smoothly with your HR systems.

Now, consider manual calculations. They can be a slippery slope, but with this software, accuracy is everything. It updates tax rates automatically, so compliance is one less thing to handle. What’s further, you can set reminders for payroll deadlines, to pay salaries on time, every time.

Finally, employees also benefit because they may examine their payslips and other perks through self-service portals. This reduces bothersome HR questions.

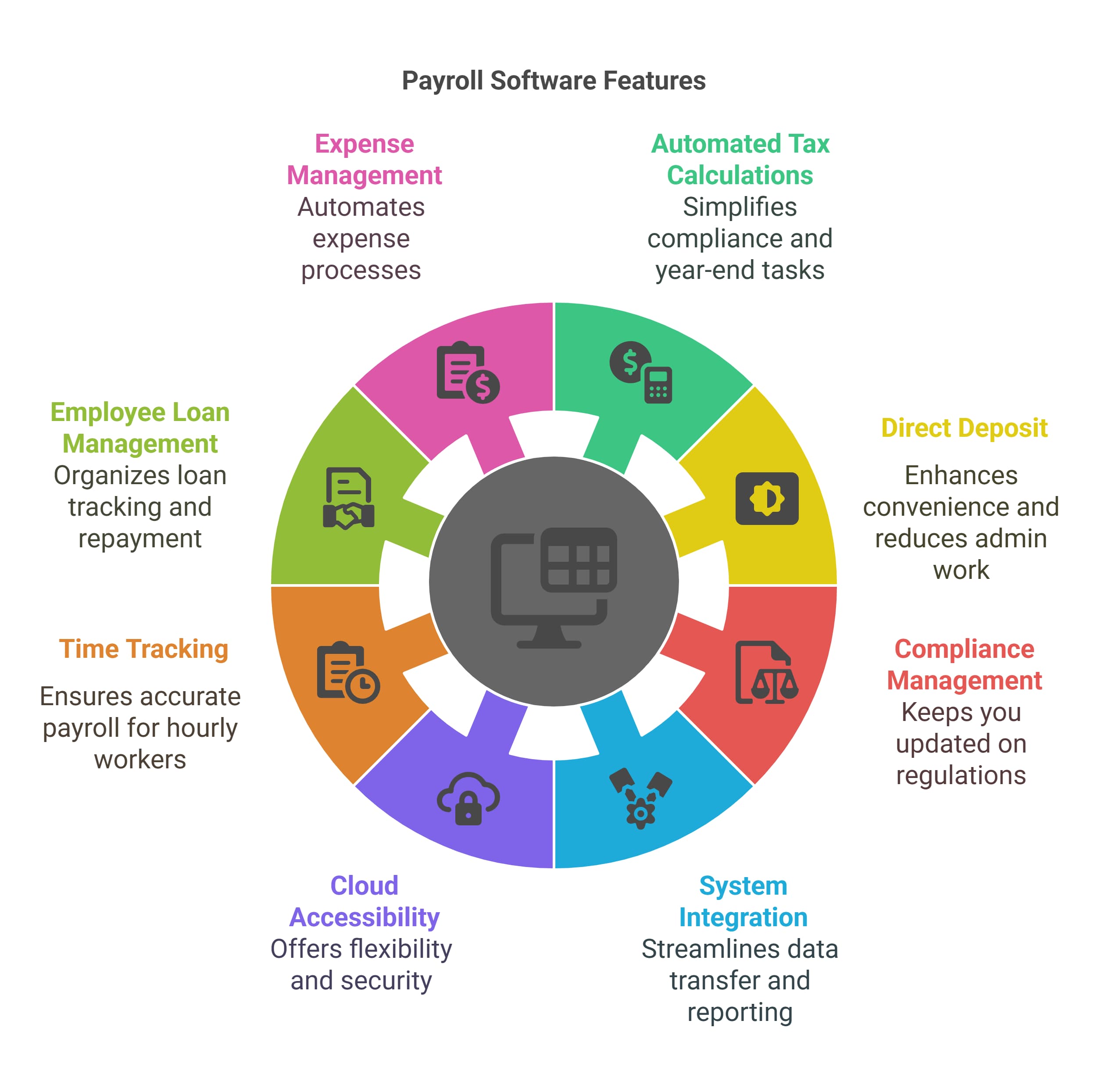

10 Essential Features to Look for in Payroll Management Software

You’re convinced that payroll management software is a must for your business. However, with countless options on the market, it’s easy to feel overwhelmed. Many people make the mistake of selecting software based solely on price, only to realize later that it doesn’t meet their organization’s needs and lacks critical functions. So, how do you choose the right one that addresses all your requirements? Here are ten must-have features to look for in your search for the perfect payroll solution.

1. Automated Tax Calculations and Filing

With payroll software, you can automate tax deductions and filings. This takes the stress out of compliance with federal, state, and local regulations. By keeping tax tables updated, you eliminate the guesswork from deductions. Finally, your year-end chores, such as creating W-2 and T-4 forms, become easy and successful.

2. Direct Deposit and Payment Options

Direct deposit changes everything. It eliminates the trouble of printing and distributing checks by enabling your employees to access their pay cheques immediately. This functionality reduces your administrative burden while also improving team convenience. Providing a variety of payment methods can greatly increase worker satisfaction.

3. Compliance Management

Good payroll software keeps you on track with compliance management. This feature provides regular updates and reminders about changing regulations, so you can focus on your business without worrying about legal missteps.

4. Integration with Accounting and HR Systems

It’s all about integration. Find software that integrates easily with your current HR and accounting systems. This makes data transfer and reporting uncomplicated and helps you maintain correct records without having to deal with the hassles of managing multiple systems.

5. Cloud-Based Accessibility

Cloud-based solutions give the flexibility you need. You can access payroll information from anywhere, enjoy automatic updates, and benefit from enhanced data security. This is especially crucial in today’s remote work environment, where accessibility is fundamental.

6. Time Tracking

How do you maintain accurate payroll for hourly employees? Time tracking is the solution. It eliminates manual entry, so more accuracy. With this feature, you can easily monitor hours worked, track absences, and manage leave balances. This way, your payroll reflects the actual work done.

7. Employee Loan Management

Do you provide loans to employees? If so, search for software that makes payback and tracking easier. Features for well-organized loan management, maintaining transparency and organization. This guarantees that staff members comprehend their responsibilities and aids in the successful oversight of the loans.

8. Expense Management

Solid expenditure management is crucial for businesses that deal with reimbursable costs like travel and accommodation. This feature automates the process of submitting, approving, and reimbursing expenses. Hence, it promotes accuracy and timely payments while keeping your records tidy and accessible.

9. Employee Self-Service Portal

Want to empower your workforce? An employee self-service portal is invaluable. It allows employees to access their pay stubs, tax forms, and personal information whenever they need it. Also, This reduces the burden on your HR team and strengthens a sense of accountability among employees.

10. Customizable Reporting

Finally, how do you get the insights you need for informed decision-making? Look for software that enables customizable reporting. This feature is crucial for financial oversight as it allows you to generate tailored datasets that align with your organization’s specific metrics and needs.

4 Additional Features to Enhance Payroll Management

You may be thinking the above ten features are present in every payroll software. What differentiates them? So look for these four additional features as well.

1. Mobile Access and Notifications

Want to manage payroll on the go? Mobile functionality lets you access important information anytime, anywhere.

2. Multi-State and International Payroll Capabilities

If your team is spread across different locations, solid payroll software is a must. It helps you solve varied tax requirements and supports multiple currencies.

3. Data Security Measures

Protecting sensitive payroll data is non-negotiable. So, go for software with strong encryption, secure login features, and regular backups.

4. Scalability for Growing Businesses

As your business expands, your payroll needs will change. Choose software that can adapt to your growth, effortlessly handling increased payroll demands without a hitch.

Types of Payroll Systems: Which One Suits Your Business?

On-Premises vs. Cloud-Based Payroll Software

| Feature | On-Premises | Cloud-Based |

|---|---|---|

| Control | Full control over data | Restricted authority |

| Security | Enhanced security | Provider-dependent security |

| Cost | High upfront costs | Lower initial costs |

| Accessibility | Limited to your company network | Reachable from any location |

| Updates | Manual updates | Automatic updates |

Full-Service vs. DIY Payroll

| Aspect | Full-Service Payroll | DIY Payroll |

|---|---|---|

| Management | Outsourced | In-house |

| Compliance | Yes | Need knowledge |

| Cost | Higher ongoing costs | Lower but the risk of errors |

| Control | Less | More |

| Time | Saves your HR time | Time-consuming |

Industry-Specific Payroll Systems

| Feature | Benefits | Challenges |

|---|---|---|

| Tailored Features | Meets industry needs | Limited flexibility |

| Compliance | Follow specific regulations | Industry-specific only |

| Reporting | Streamlined industry metrics | May lack general reports |

| Support | Specialized support | Fewer vendor options |

| Integration | Works with industry software | Compatibility issues possible |

The Future of Payroll Management Software: Trends to Watch

The future of payroll management software looks promising! You can expect AI to take center stage. Why? Because it reduces your errors and saves you precious time. Automated compliance updates will keep you on the right side of regulations.

And that’s not all—better data analytics will turn uninterpreted data into useful insights. This means you can make informed decisions that truly impact your bottom line. So, business owners, to keep ahead, opt for software that’s adaptable and can grow with you.

How to Choose a Perfect Payroll Provider

Know Your Needs:

Compare features and pricing.

Explore Options:

Compare features and pricing.

Stay Compliant:

Ensure they keep up with tax laws.

Tech Savvy:

Look for user-friendly software.

Support Matters:

Check for reliable customer service.

Try Before You Buy:

Request a demo.

Read the Fine Print:

Understand fees and terms.

Get Feedback:

Ask fellow business owners for their picks.

Future-Proof:

Choose a provider that grows with you.

Make Your Move:

Pick the best fit for your business!

Why Choose ConnectSimpli Payroll?

Do you want more clarity, or maybe just a solution that answers your needs? If you’re looking for a straightforward recommendation, here it is ConnectSimpli. Why, let’s check out the details.

Streamlined Payroll Process: You can adjust pay, review changes, and approve payments with ease. So, no more stressful payroll headaches!

Competent Staff Management: Maintain a well-organized team. Keeping track of personnel details is easy with ConnectSimpli.

Digital Tax Services: Exhausted of tax stress? Use cutting-edge technology to easily maintain compliance and automate computations.

Comprehensive HR Module: Manage HR tasks like leave requests and document signings on the fly. With mobile access, everything is just a tap away.

Robust Data Security: Your sensitive data is in safe hands. ConnectSimpli prioritizes security to protect what matters most.

Insightful Analytics: Discover trends within your workforce. Our advanced reporting helps you identify opportunities for improvement.

Time-Saving Automation: Ditch manual tasks! Automate payroll and HR processes so you can focus on what truly drives your business forward.

Flexible Pricing Plans: No one-size-fits-all here. Start for free with essential features and scale your plan as your business grows.

Expert Support: Got questions? Our 24/7 online support is ready to guide you through every payroll challenge.

So, connectsimple offers all needed help for your business. Now its your time to take action!

Frequently Asked Questions (FAQs)

Core features like automated tax calculations, compliance management, and direct deposit options make payroll software highly efficient.

Payroll software updates tax rates automatically and provides reminders, helping businesses meet regulatory standards without manual updates.

Cloud payroll solutions provide flexibility, secure data access, and allow payroll management from anywhere, supporting remote and hybrid work models.

Employee self-service portals allow staff to view payslips, update details, and access tax forms, reducing HR workload and improving transparency.

Many payroll solutions offer multi-jurisdictional support, automating tax calculations for various states and handling different currencies for international teams.

Payroll software with expense management automates expense approvals, tracks reimbursements, and integrates with payroll for streamlined processing.